Hindsight and crystal balls

Every 7 to 10 years, the property market endures a correctional phase. You might think that’s a throw away phrase, as it is one that agents use often, but the numbers back it up. There are many valid and understandable reasons for this; some sneak up on us uncharacteristically quickly, and others are odds-on predictable, but we’ve seen them all – in one shape or form – before. I’ve been in this industry for almost 20 years, so you can trust me when I say that this is not unchartered terrain, albeit a different path.

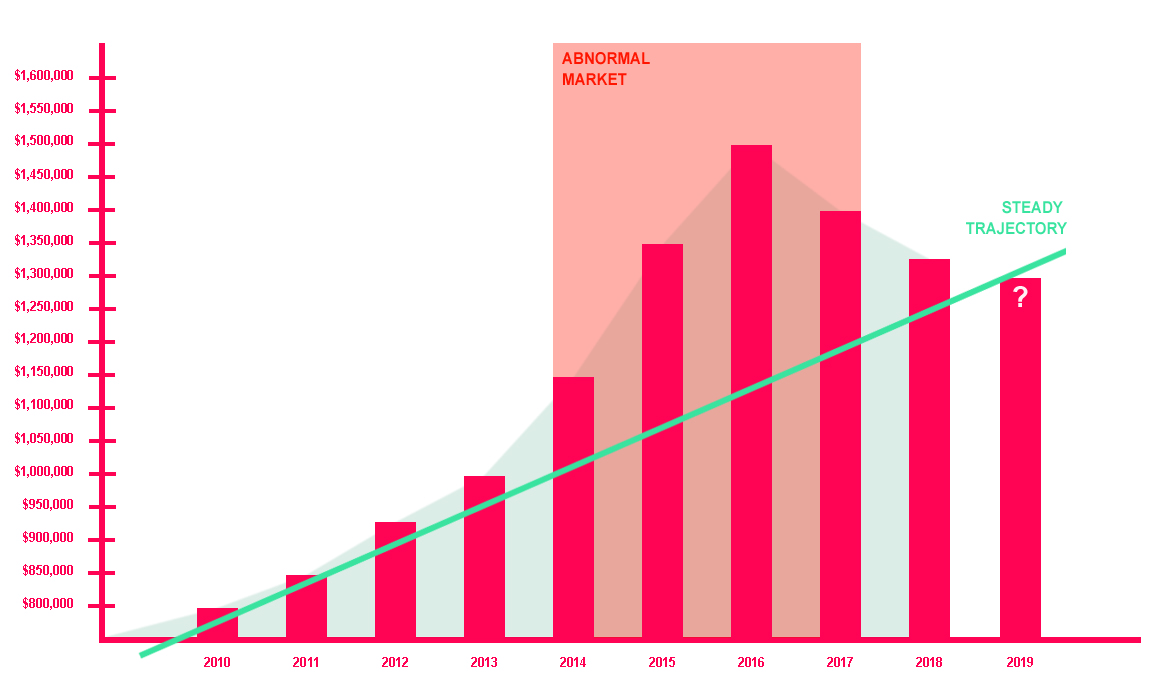

Before we delve into the intricacies of what’s going on, lets take a look at a ‘typical’ Hills District suburb growth chart over the past few years. Prices are approximate to show flow.

2010: $800,000

2011: $850,000

2012: $925,000

2013: $1,000,000

2014: $1,150,000

2015: $1,350,000

2016: $1,500,000

2017: $1,400,000

2018: $1,325,000

Undeniably, 2014-2017 saw most property values in the Hills District grow faster than they otherwise had been in the preceding years (not that they were too shabby themselves). Many homes saw a 50% increase in their value in a 48 month period! A lot of this growth was due to skewed supply/demand ratios – there simply weren’t enough houses being sold to keep up with the demand, which created heated competition for the fewer properties that were being sold. Whilst this trend was Sydney-wide, The Hills was a huge beneficiary.

Historically low interest rates during this period meant that money was, for want of a better term, easier to get due to the typical mortgage repayment being lower than it had been in a generation. This not only led to a surge in people upgrading their property, but also a rise in investor activity, attracted by not only rental yields but also the newfound spike in asset growth. Add to this a perfect storm of positive bureaucratic and legislative activity as the Hills District was finally benefitting from decades’ worth of Government(s) promises of infrastructure such as the North West Rail Link, road upgrades and land re-zoning. Shops and schools started popping up, and Sydney’s growth corridor was, as they say, hot property.

Seeing the house down the street sell for big bucks encouraged an onslaught of property to come onto the market in an attempt to take advantage of the high prices. Whilst completely understandable, the result was an oversupply of both sales and rental stock. Buyers were now spoiled for choice. If they missed one, they could just wait for the next. They could haggle. Similarly with the rental market, lower rental yields began deterring some investors.

I believe that prices today are exactly where they should be. The prices of 2014-2017 were abnormal. An unsustainable spike.

Sellers, I urge you to stop punishing yourselves by looking back at 2 year old prices and suggesting that, by selling for what your house is now worth in 2019, you’re somehow losing money. I could sit here and say that I lost $1m by not putting $10K on the winner of the Melbourne Cup the day after the race. Not only are you talking with 20/20 hindsight, the windfall is completely hypothetical. You didn’t list then. You didn’t sell then. With all markets being relative, any ‘bonus’ money you may have received by selling in 2016 would have been spent covering the increased value of the house you would have also needed to purchase in 2016.

Unless you bought between 2014-2017 with the hope of turning a quick profit, the majority of home owners in the Hills are still making a great deal of money when selling today. Real estate should always be a long game. Over the long term, you just can’t beat it. There is great value in the Hills market, and if you’re buying and selling at the same time, then it’s all relative. Don’t let the media deter you. The sky isn’t falling. Buyers are still buying, and houses are still selling… for what they’re worth in a 2019 market.