Guess who’s back..?

FOMO! The most overused headline in real estate journalism throughout the boom of 2014 – 2017 was FOMO. For the unacquainted, FOMO is an acronym that stands for the ‘Fear Of Missing Out’, and you couldn’t turn on a television, open a newspaper, or scroll through Social Media without seeing a story that contained the narrative around FOMO, and the critical part it played in driving property price growth throughout Sydney (and, much of the country).

The abridged version: Interest rates were (are) at historic lows, meaning many people could afford to borrow and repay more money than they ever could before. When a property hit the market, buyers with access to this money were outbidding each other to secure that asset, and a lot of the time that bidding was reaching irrational levels.

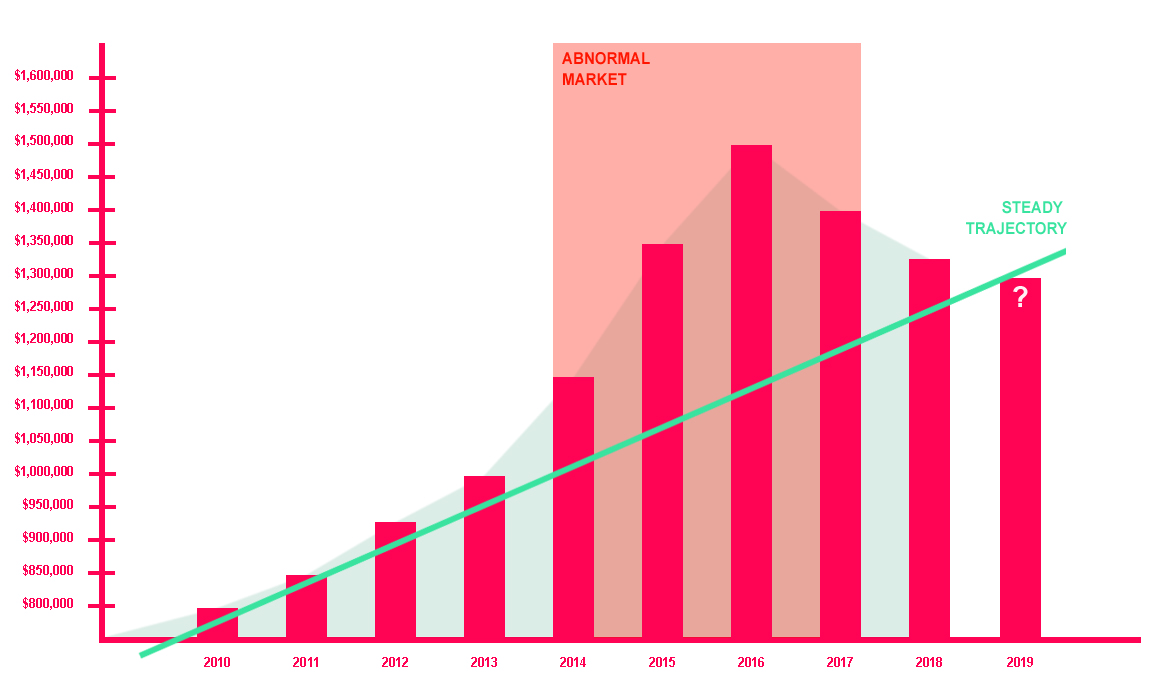

Properties with reserves of $800,000 were regularly selling for $1,000,000. If it had a $1.5m guide, it was a chance of scraping $2m by the time my gavel fell. That’s not to say that the owner wouldn’t have accepted the guide price, it’s just that the FOMO was strong. The thought process was “we’d better buy now before prices keep skyrocketing”. The momentum was entirely self perpetuating. Everything was selling, and for big money. And then…

Lending starts to get tighter. Lower rental yields meant investor activity started to disappear. First home buyers were priced out of the market. Competition starts to dissolve. Fewer buyers means owners are more willing to negotiate. The market starts to organically correct itself as it always does.

So, we’re now in 2019, and with prices at their lowest levels in 18 months, why is FOMO charging back into the narrative? Because it’s evolved!

FOMO has now turned into the Frustration Of Missing Out. #FOMO2019 y’all!

If a vendor is on the market in 2019, unless they’ve been living in a cave somewhere, they know about the correctional phase that the market is in, and the price drop in their area. If they’ve owned their home for longer than 5 years, they’ve likely seen its value increase by 50% before more recently coming back down to Earth to the tune or around a 15% drop. Having factored this into consideration, the asking prices we’re seeing in the market at the moment are very much attuned to the 2019 real estate environment.

So, why the FOMO?

Land with auction guides of $530,000 is selling for $555,000 on auction day.

Units with auction guides of $750,000 are selling for $775,000 on auction day.

Houses with auction guides of $1,250,000 are selling for $1,280,000 on auction day.

Every weekend, there are buyers waking up on Sunday morning and seeing that the property they loved (but didn’t bid on) has just sold for bang-on its guide. Or, maybe $20K, $30K, $50K above its guide. Every Monday morning, buyers are ringing agents saying “Oh, we’d have paid that!” or “We thought it would go higher than that so we didn’t register“.

There is a huge sentiment of frustration seeping into the marketplace, and it’s the frustration of missing out.

To a degree, I get it. There has been a recent pattern of auction guides being smashed, and it felt like every auction sale was a record of some type. That’s simply not the market we’re in now. Sellers understand this, and are being realistic when it comes to their expectations around sale price.

Right now is THE best time to buy and THE best time to upgrade that I’ve seen in the last decade. Sellers are realistic, and in the overwhelming majority of cases, so are their reserves. If you’re looking to buy, give yourself the best chance at taking advantage of the market. Offer pre-auction, or register to bid at auction. There’s going to be a tonne of people in 2021 looking back wishing they bought in 2019. The FOMO is real.